A robot is a programmable, semi-autonomous machine capable of moving on two or more axes within a defined environment and carrying out set tasks. Revenue in the UK industrial robotics market is projected to reach c. £180m in 2024, rising to over £220m by the end of this decade on predicted mid-single figure trend growth.

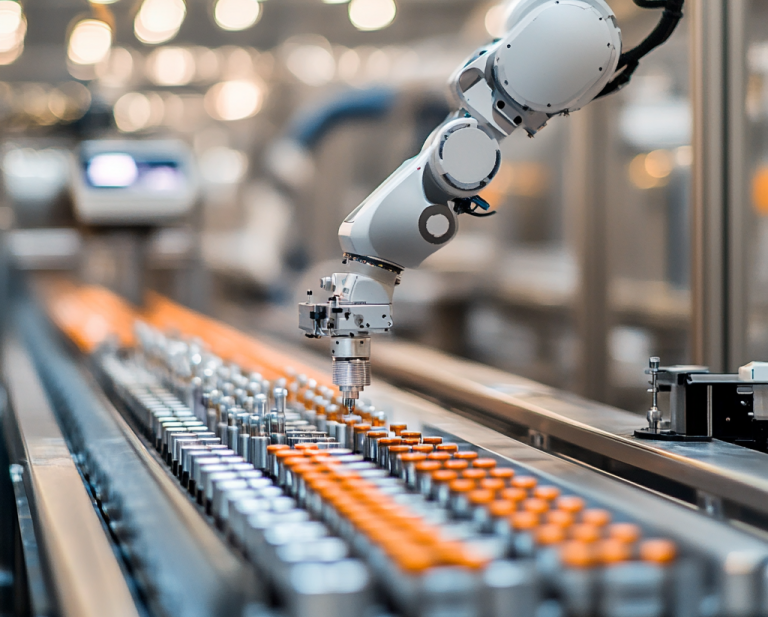

Robotic automation is increasingly commonplace within modern-day industrial manufacturing and production in the automotive, chemicals and pharmaceuticals, metals, electronics and food & beverages sectors and other sectors. Robotic systems are now routinely deployed to improve process efficiency and precision in areas such as materials handling, machining & welding, goods assembly, painting & coating, packaging & labelling among other repetitive processes in circumstances where manual operatives would otherwise prove inefficient and inaccurate at sub optimal rates of production output.

Allied to the design of the physical robotic hardware, a system’s often bespoke controlling software can analyse production data and optimise operations configuration. The relative ability of an OEM’s robotic system to interface, integrate and communicate with a third-party OEM’s system within the same end-customer user setting is often fundamental to an installation’s success. It is therefore within the power of a vendor to create substantial project value by providing the end-user with a full, turnkey robotics solution. Here, the one OEM will engage directly with the end-user to assume whole-of-project contract responsibility – inclusive of all third-party systems integrations – across each stage of the project from initial systems concept and design planning to prototype modelling, site installation, commissioning and final handover.

Barriers to entry

Barriers to market entry within the field of advanced automation and industrial robotics are five-fold, based on:

Non-established market participants may also find it difficult to procure critical and hard-to-source items, such as automation control systems. Within the established supply chain, much kudos is attached to the strategic supply partnerships that are maintained between a number of the robotics OEMs and their suppliers. These suppliers, typically, large German or American corporates can be selective with whom they partner. Furthermore, these arrangements may be extensively sales volume and value influenced in a given geographical region.

OEM sales leads in the robotics industry are often generated as a result of word-of-mouth recommendations. Additionally, the selling process across much of the sector follows a primary course of ‘engineer-to-engineer’ technical specification dialogue. An OEM’s ability to refer a potential customer to another customer’s installation in the relevant industry segment via a site visit is often a critical element of the sales process. On-the-ground ‘success stories’ allow design concepts to be vetted ‘first-hand’ by the visiting engineer, permitting technical ‘buy-in’ before final contracts are agreed with a customer’s central purchasing function.

Demand drivers

Demand for industrial robotic automation is extensively four-fold, driven by end-user capital expenditure intentions, new product manufacturing introductions, product format alterations and production process changes.

A sales enquiry for the design and supply of a bespoke single robotic module might generate OEM revenues of c.£300-400k in value, depending on the product’s specifications, although cheaper ‘off-the-shelf’ units are available. The more complex customer order – involving, for example, the integration of 3-10 interconnected robotic machines – could represent a project of significantly greater value, generating revenues of c.£2-5m+. End user operational expenditure on post-installation maintenance, repairs and emergency services are a strong secondary revenue stream for many OEMs.

A strong USP within the industry rests in relative willingness of the OEM to offer customers a bespoke systems layout designed to suit precise constraints of space within the end user’s installation setting. Whilst the robotics industry sector consists of many machine builders, comparatively fewer are bespoke systems integrators in this context.

Sector competition

The principal elements of inter-company market competition in the advanced robotics OEM sector are engineering design capability, build quality and site installation timeliness. To this, one may add adherence to target production efficiencies and cost-reductions previously agreed with the customer. However, unit pricing alone is of a lower order of vendor selection importance, although this can be industry sector dependent.

Within the pharma and medical device end-user sectors, for example, a typical RoI ‘sweet spot’ for a new robotics line project proposal might be c.4-5 years. In food & beverages, it would be shorter at c.18-24 months. Food producer contracts with UK supermarkets tend not to extend beyond c.2 years so building the case for a new-build robotic line or extensive line modification to suit a new style of retail packaging, for example, demands a shorter payback. Longer project specification gestation times in pharma, med-tech and bio-tech, for example, mitigate against more frequent vendor rotations.

Sector outlook

The Autumn Budget on 30Oct’24 did not announce any immediate changes to the full-expensing regime’s status after 1Apr’26. The policy of full expensing — a tax relief allowing 100% deduction of qualifying capital investments — remains in place for this Parliament, but no definitive commitment was made to make the regime permanent beyond the current timeline. The withdrawal or partial dilution of full-expensing would have immediate and negative ramifications for robotics sector investment.

Elsewhere, the outlook for UK manufacturing as could influence robotics demand is mixed, for example:

Looking ahead at the trends that could shape future demand for industrial robotic automation, one may predict:

In summary, enhanced robotic control technologies will increasingly boost industrial productivity by maximizing functionality, improving accuracy, reducing waste and increasing uptime.

CSA’s strategy and due diligence advisory services sit alongside and complement the day-to-day activities of company management. We provide independent and objective evaluations of strategic direction and customer value creation, providing a road map for business performance improvement.

For information about how we can help you to assess business and market attractiveness please call: 0208 947 5108.