With rising geopolitical instability and a looming trade war, the risks for UK business in a flatlining domestic economy are creating a more uncertain trading outlook on multiple fronts. How might business managers and funders assess their options for growth and expansion?

2024 saw quieter growth and investment for many businesses, with slower deal flows for private equity sponsors at large. However, the decisive election win by the incoming Labour administration could enliven prospects as the new government sets its agenda for political stability and economic growth.

Eyesight degenerates with age and as the UK population grows older, opticians’ foot traffic will increase. Additionally, about 70% of adults are overweight or obese, a condition linked to serious eye issues, such as diabetic retinopathy, glaucoma, age-related macular degeneration and cataracts – conditions that can lead to significant vision loss. Meanwhile, extended screen times from desktops and smartphones are at a cost to eye health. Adding to all, today’s consumers view eyewear differently, influenced by changing fashion trends and not just functionality.

Entrepreneurial SMEs demonstrating sustainable earnings from a seemingly defensible position in a recognisable market segment are inherently attractive to financial backers. Additional funding can propel the business to a next stage of growth and development, making an appealing investment case. But business entrepreneurs may operate as unconstrained ‘free rangers’ and ‘niche today’ can mean ‘gone tomorrow’.

Personal image carries greater importance in today’s society. In an era dominated by social media, selfies and celeb-culture, today’s consumer spending decisions are increasingly about lifts, implants, fillers and lasers as aesthetic interventions become the norm. This is creating new business and investment opportunities for healthcare services providers and medical and surgical equipment suppliers.

Businesses seeking sustained market success must favourably differentiate their offerings to compete against rivals. Companies without an adequate understanding of their customers’ needs face market share erosion and commoditisation.

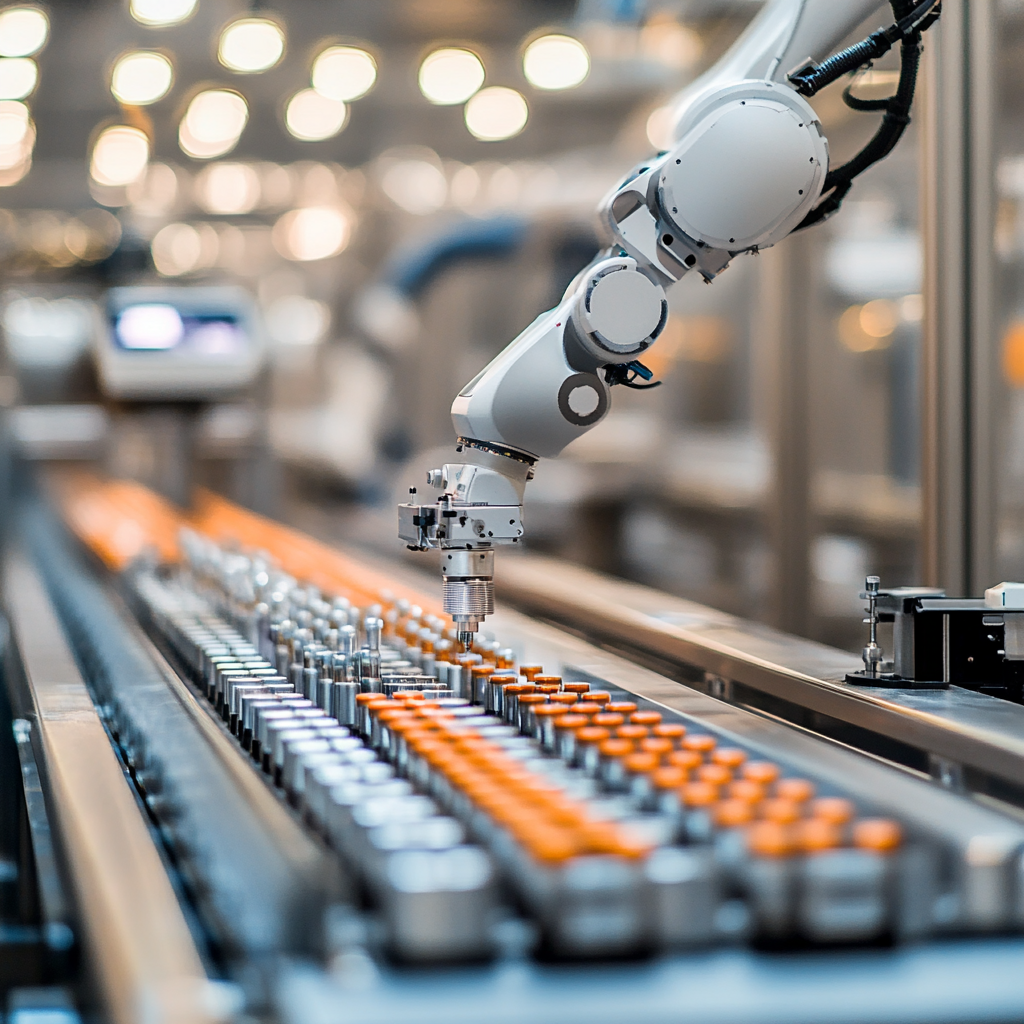

Advanced robotic automation provides a means to overcome barriers to business in UK manufacturing and production created by rising costs, labour market tightness and the competitive need to improve efficiency. Investment in digitalisation and other technological advancements stimulates sector growth, creating opportunities for businesses and their investors. Yet the financial and other hurdles can be considerable.

Investors, lenders and business owners may struggle to speak the same business language during a transaction. While business owners and managers see opportunities, financial backers may interpret risk. Independent due diligence can play a valuable role communicating the translation of the pragmatic risk and reward issues that could be fundamental to deal success.

With the UK government spending heavily and choosing to increase the country’s borrowing and taxation at a time of rising geopolitical uncertainty and a looming trade war, now may be the time for company owners and their financial backers to re-evaluate their business’s competitive strength and enduring advantage ahead of firming up on strategic direction.

Private equity sponsors and corporate lenders requesting independent due diligence in connection with a transaction can face a tricky situation. They do not want to appear to lack faith in the business’s management team, nor do they want to seem to challenge the view that ‘management’ knows its business and markets best. Nonetheless, some questions need to be asked to provide comfort in the deal.