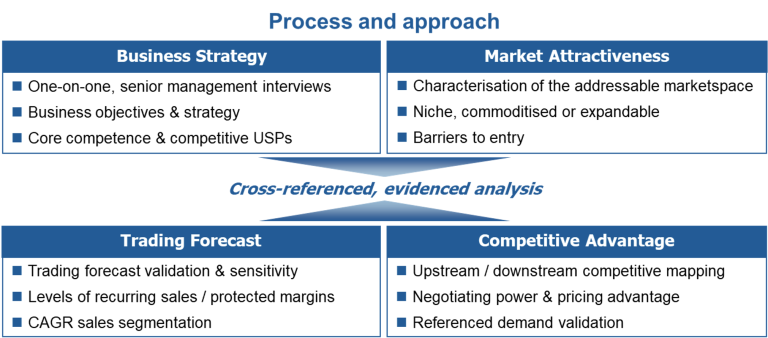

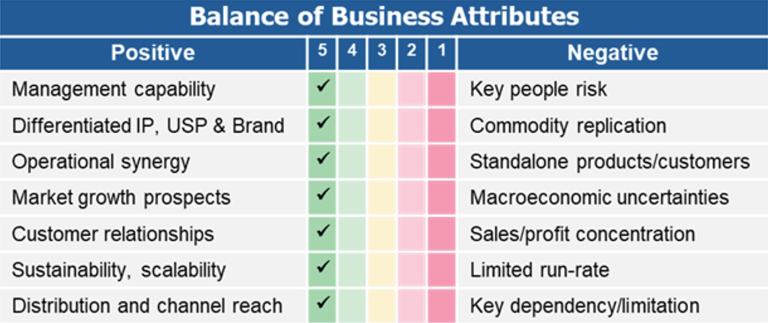

Independent due diligence seeks to understand the value, rationale and logic behind a company management team’s decision to pursue a chosen or intended market direction. It evaluates the benefits and risks associated with a management team’s market positioning and entry into new markets. Additionally, it assesses whether the sources of the company’s competitive advantage are sufficient to meet customers’ supplier selection criteria in the face sustained market competition.

Of course, what one person views as a risk, another may see as a valued opportunity. For diligence to be effective, the reporting consultant advisor must identify and analyse the key standout issues, gather evidence, and communicate a well-founded final opinion, knowing what will give comfort to clients’ decision making.

Delivered insight and opinion in the realm of all consulting advisory services can be highly subjective. Given the tight deadlines typical of corporate finance, a crucial aspect of the ‘art’ of conducting due diligence is knowing when to conclude an analysis, substantiate findings and present the final body of work.

The level of granularity in the analysis is crucial. High-level, limited scope diligence can effectively address straightforward, singular issues within a business. However, more complex situations — such as multiple revenue streams across different geographical sales territories — may require more comprehensive analysis.

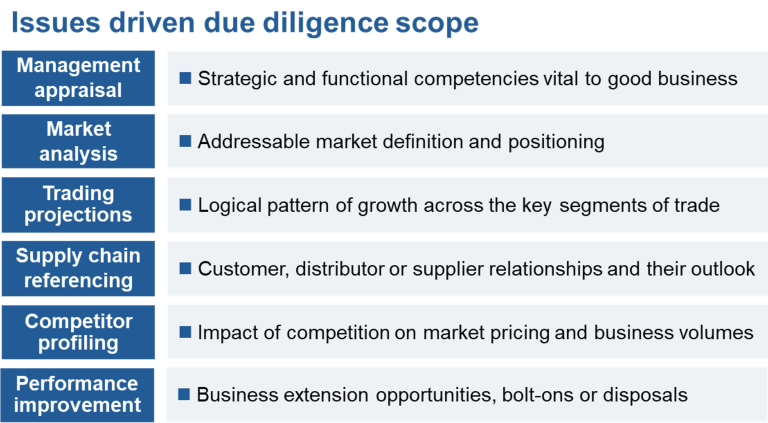

The variables examined by due diligence within the scope of a client project may include, for example, a review of a company management team’s experience in setting and meeting business objectives in the form of cross-functional key performance indicators (KPIs); the alignment of business forecasts with historic earnings, given economic assumptions about the nature of addressable market; the strength of relationships with customers, both formal and informal; and the impact of competitor activity on customer pricing.

Is there an alternative to due diligence? Absolutely – you can always take company management out for a lengthy chat over a few beers… and then look them in the eyes!

CSA’s strategy and due diligence advisory services sit alongside and complement the day-to-day activities of company management. We provide independent and objective evaluations of strategic direction and customer value creation, providing a road map for business performance improvement.

For information about how we can help you to assess business and market attractiveness please call: 0208 947 5108