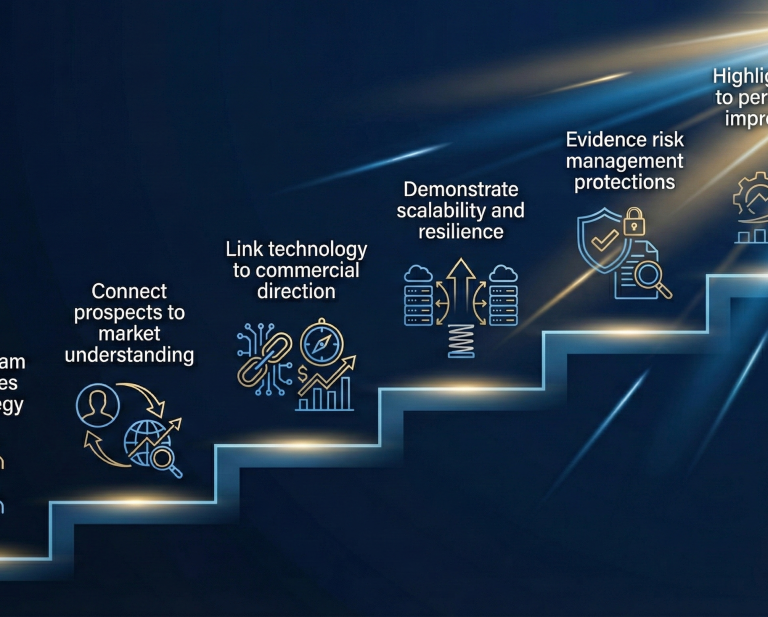

Step-1. Showcase team competencies vital to business strategy: Demonstrate that your management structure, skills and capabilities are strategically aligned with clearly mapped product development steps and market introduction plans. Acknowledge resource gaps and functional limitations and address them proactively to build confidence among stakeholders. Be realistic about growth ambitions and timelines.

Step-2. Connect growth prospects to market understanding: Define the business’s addressable market to show a logical pattern of intended sales growth in key segments. Give transparency to the business forecast by sensitising planned revenues from identified customer acquisition targets, in a pipeline of opportunities. Rank their probability of conversion within a timeline of commercial traction.

Step-3. Link technology to commercial direction: Articulate how the company’s technology supports the business model and serves as a strategic differentiator. Highlight the purpose, proof of concept and end-user RoI. Emphasise core IP, patents and the tacit knowledge contained within the business, conferring ‘first-mover’ market advantage over nearest rivals.

Step-4. Demonstrate business scalability and resilience: Explain the growth story through regulatory approvals documentation, customer installation locations and sales distribution network coverage. Unveil the business’s readiness for innovation and capacity for fresh income in key areas, such as AI and next-gen automation, in addition to secondary revenues from extended warranties and service support packages. De-risk the business, particularly in the eyes of investors or future acquirers, by flagging barriers to entry where these prevent competitor business replication.

Step-5. Evidence risk management processes and protections: Demonstrate control of the supply chain by addressing third-party dependencies. Present clear operational risk assessments, including mitigation strategies. Highlight cybersecurity measures, data security protocols and resilience against threats such as ransomware.

Step-6. Highlight routes to business performance improvement: Seek opportunities for cost reduction, customer value enhancement and service extension, where continuous improvements drive sustainable growth and profitability. Are growth targets attainable in a meaningful timeframe to investors? Should current backers hold and reinvest, or would they be better advised to seek an early exit, liquidate and redeploy elsewhere?

In Summary

By focusing on these strategic pathways, early-stage and IP-rich tech businesses can more optimally position themselves for long-term value creation and prepare effectively for future investment or exit opportunities. If you would like to discuss how these strategies can be tailored to your portfolio, please get in touch.